Hello everyone,

I recently got invited to a blogger meet, it was my first and must I say how happy and delighted I was as it was something that interests me. I have always been an independent woman from the time I knew that I can make use if this opportunity. So I was definitely excited to be a part of Reliance Mutual Fund’s Reliance Retirement Fund whose tagline is “Lambi Innings Ki Taiyari”

|

| Image Courtesy- BlogAdda |

I am a person who can never see my account balance sitting idle, after all an idle mind is a devils workshop, so then I would definitely see a lot of credit bills being paid by me and in the end I would be like no money, so funny.

To avoid my financial crunch situation I believe in save and invest first and then spend. But then these investments I know would just help me feed few of some desires but would never help me life a satisfied and happy life that I am living right now when I retire. 🙁

This particular problem of many people in different age groups has been now resolved by the Reliance Retirement Fund, which lets you start investing in the scheme at a young age to secure and enjoy a happy innings of your life post retirement.

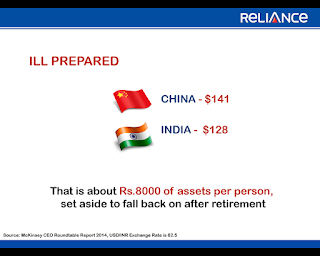

At the meet, the top brass of Reliance Mutual Fund conducted a very informative session on the same, and I am sure all bloggers like me were shocked by the glaring statistics and how ill prepared India is in terms of retirement.

|

| Image Courtesy-Reliance Mutual Fund |

The company did an excellent research on the ill preparedness of India and came out with the scheme as a solution to end this crisis.

The fund has two phases that is the accumulation phase where one invests in the fund in order to build retirement assets and the second phase that is the distribution phase where one enjoys the benefits of the first phase.

The fund is divided into two schemes i.e. Equity and Debt Oriented Retirement Solutions. Depending on the cup of risk one may invest in either of the schemes, however fret not they give full clarity to determine the percentage of equity and debt one would like to have in the fund. All this at no additional cost with the benefit to switch unlimited times in the scheme and between the two schemes too.

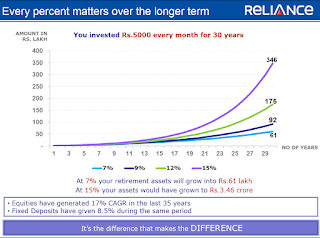

One may want to invest through both SIP (Systematic Invest Plan) and lump sum over the earning years. One can also increase the SIP amount with increased earnings over the years. 😀 Currently the minimum amount is INR 5,000 and INR 500 for lump sum amount and monthly SIP respectively.

In case of any un-surety, one can check out their Retirement Calculator and you will get an approximate figure of your required investment in the scheme.

|

| Image Courtesy- Reliance Mutual Fund |

To enable a sense of responsibility towards one’s retirement there is 1% load on redemption before the age 60 subject to lock in period of 5 years.

For the “is there any tax benefit on this “people, yes there is, one can claim a deduction u/s 80C for your investment made in this scheme in a financial year.

Why do the traditional method of investing in only fixed deposits which earn us an interest which we very well know can’t beat inflation and also the fact that the value of money depreciates every year, rather invest in this scheme which lets one live the same happy lifestyle now when one retires.

For all the youngsters out there, the earlier you start investing and planning for your future, I am sure you will pat your back when you’re older for starting early. As Sundeep Sikka, CEO of Reliance Mutual Fund said “You youngsters need to sacrifice just one movie a month for a #LambiInningsKiTaiyari “

I was happy and content after this meet, as it enlightened me with something that everyone should know, and that is “All our life we work for money, Its time money works for us “