Situations of our life are so much filled with #IfsOfLife like what if this, what if that?

The #IfsOfLife somehow doesn’t seem to end no matter what, as every choice you make poses a simple question, what if I had chosen the other alternative. It’s a never ending saga altogether.

A week back I wrote about how Bajaj Allianz was going to launch a new product on 23rd December that was going to be a master stroke to take care of your #IfsOfLife.

I attended the meet which was not only an interesting session but a very insightful one too where the company experts answer all our queries really well.

LIFE, this four letter word has an IF right in between of it, after all what if you are not able to cope up with the uncertainties of life such as an accident, permanent disability, critical illness etc.

These ifs of life are never ending and hence to combat with #IfsOfLife Bajaj Allianz Life introduced the Bajaj Allianz Life eTouch Online Term which is a pure term insurance plan and is available exclusively online only.

Most of the people confuse life insurance plans as savings plan, but this is a pure term insurance and health cover plan that is meant to protect the financial future of your family.

The Bajaj Allianz Life eTouch Online Term has four different variants as shown below. One can choose either of them to face the bouncers of uncertainties life throws at us.

The following are the 34 critical illnesses covered by the Shield Supreme Plan which is a pure term and health cover plan.

The best part of the e-touch online term is that the minimum sum assured is 50 lakhs which is excellent as we humans tend to not value our lives as much as it should be.

The other amazing benefits are that the maximum age at maturity is 75 years and the premium is lower for non-tobacco users.

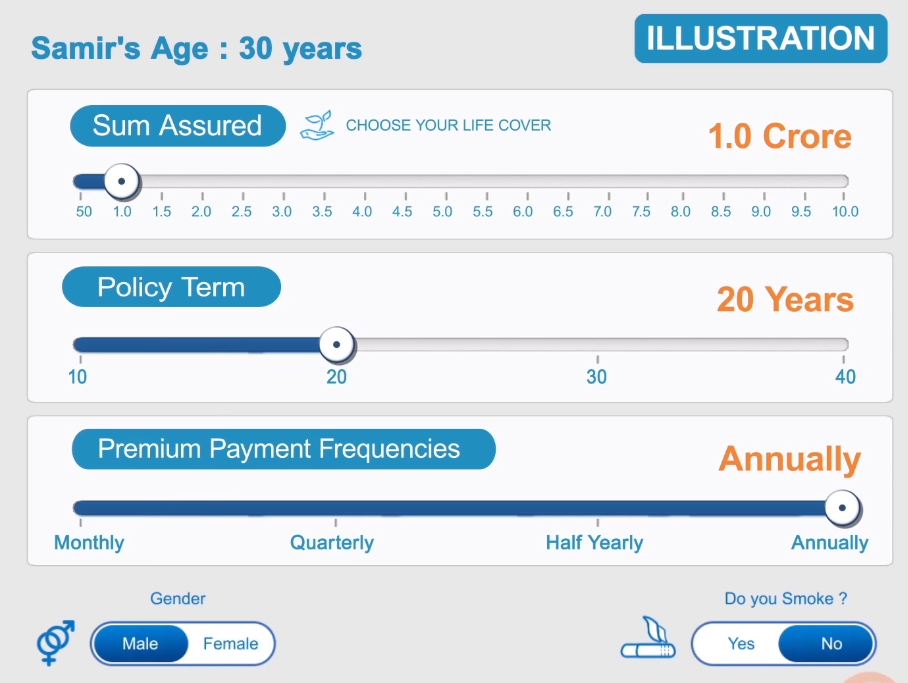

The following illustration below will help to understand how one can choose their policy online.

As per the following choices Samir’s premium payment yearly for the Shield Supreme Plan is approximately INR 19,273

In the case of Accidental Total Permanent Disability (ATPD) an amount equal to the sum assured (subject to maximum of 2 crores) will be paid as ATPD benefit and all future premiums will be waived off and the policy will continue with life cover.

In the case of a critical illness 75% of the sum assured will be paid and the future premiums will be waived off and the policy will continue with the remaining benefits.

In the case of Accidental Death Benefit (ADB) it depends on the sum assured for ADB and whether critical illness sum has been paid or not.

All in all, the variants are complete packages on their own enabling one to beat the #IfsOfLife accordingly.

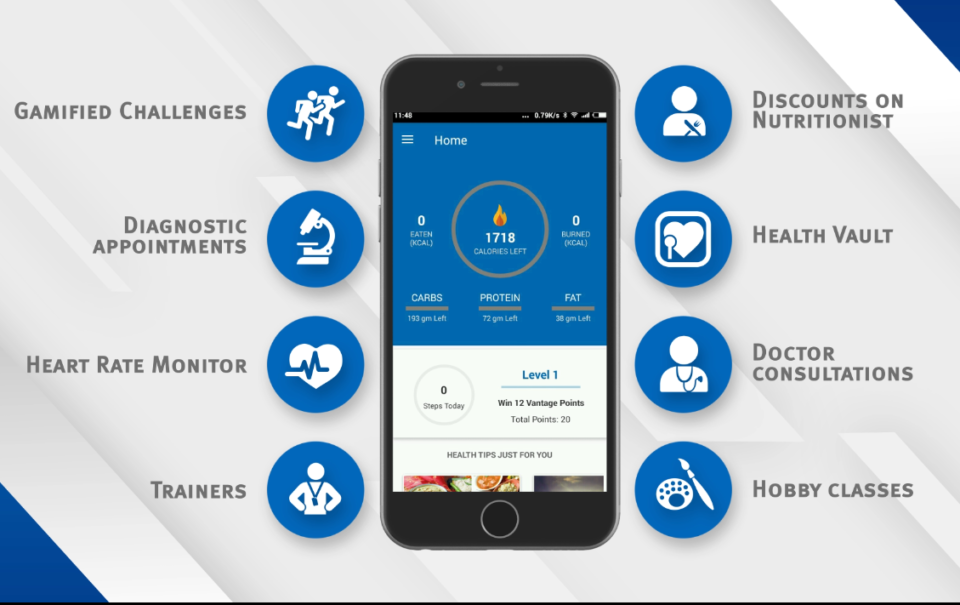

Next that was up on the sleeves of Bajaj Allianz Life was the launch of the B-Fit app which helps us live by the principle of eat healthy and be healthy as health is wealth.

B-fit is a mobile app focused on keeping one healthy and fit while rewarding with Vantage points for keeping oneself healthy.

You can set your goals either for losing, maintaining or gaining weight. The app also gives you daily challenges to complete.

It auto tracks all your activities and rewards you for achieving your targets.

It helps you to get healthy by being a monitor diary, food guide, step tracker and a personalized health content app.

It also provides you with some healthy and useful features mentioned below.

Bajaj Allianz Life with its recent launches to combat with the #IfsOfLife shines proudly with its vision of “To be the best Life Insurance Company in India- to buy from, work for and invest in” and to #JiyoBefikar

Disclaimer:- Financial instrument recommended for review; however my opinion and thoughts are true and honest.

There are 2 comments

That’s quite a good initiative…

I agree, we have too many ifs in our life. But can’t escape as trust takes time to build. Nice article.

Sapana V recently posted…Uncommon Hindu Names Starting with letter “K”