The financial sector in the world has grown by leaps and bounds, amazing for each one of us, as now so many things are available to us at a click of a button.

However there are many things that are still required to be complied in terms of individual financing which sadly have not grown at the same pace of the evolution of the finance sector.

How many times in our lives, each one of us has faced the dilemma of borrowing or lending? One of the most common reasons of worry for borrowing is the rejection or for lending, the chances of default.

We all know that in today’s time it’s not an easy task to just walk into a bank and demand for a loan to be sanctioned, or to demand for a higher rate of interest for lending funds in the form of deposits.

Due to issues in the past with the financial sector and thus the enforcement of certain entry barriers for borrowing, it has become difficult for one to get a loan easily without having the required documentation to approve the same.

A trend analysis would tell you that either one wouldn’t possess all the required documentations to be eligible for loans, or incase if one does have all the documents either there is some aspect that is missing or the entire process takes so long that the time factor beats the entire purpose of borrowing.

Alas! With these issues that exist with borrowing, either one has to forget their dream idea or plans because borrowing would be just outside one’s reach.

From the lenders’ point of view also, it’s difficult to lend funds to a person directly as it’s not an easy task to verify the borrowers’ credentials. So the only option that remains with a lender is to let the surplus amount remain in his savings bank account which would then be rolled further by the bank to the borrowers.

In the bargain, the lender usually earns an interest rate of around 4%-6% p.a. on his savings and the bankers earn around 9%-13% p.a. without offering anything to the lender in return.

To bridge this gap, peer to peer lending, also known as P2P lending was born in early 2005, introduced by a company named Zopa in the UK.

Peer-to-peer lending is an online platform where lending money takes place to individuals or businesses through lenders directly dealing with borrowers.

This form of lending has been growing at a fast rate since the time of its inception because of its benefits that supersede traditional financing channels.

In P2P lending, both the borrower and the lender are the kings/queens because either of them have a choice to lend and borrow at the rate and to whom they are comfortable with.

If the lenders’ and the borrowers’ rate of interest matches, the loan is processed and thus it’s a win- win situation for both the parties.

In India as well, P2P lending is in force and i2iFunding is in the lead in this initiative, which is an online platform for lending that was launched in October 2015 after a great deal of efforts and thought process put in by 5 entrepreneurs who decided to bridge this gap.

The founders are experts in their field having strong financial, operational, marketing, brand management, product development, advisory board and have a great team which put together is leading to the success of this P2P lending platform.

i2iFunding.com has also been awarded Startup of the year 2016 by Silicon India and is trying their best each day to increase the trust of people towards this alternative way of funding from the traditional financing method.

In the coming weeks, the RBI is expected to roll out certain guidelines to regulate the P2P lending, which will further enhance the trust of investors.

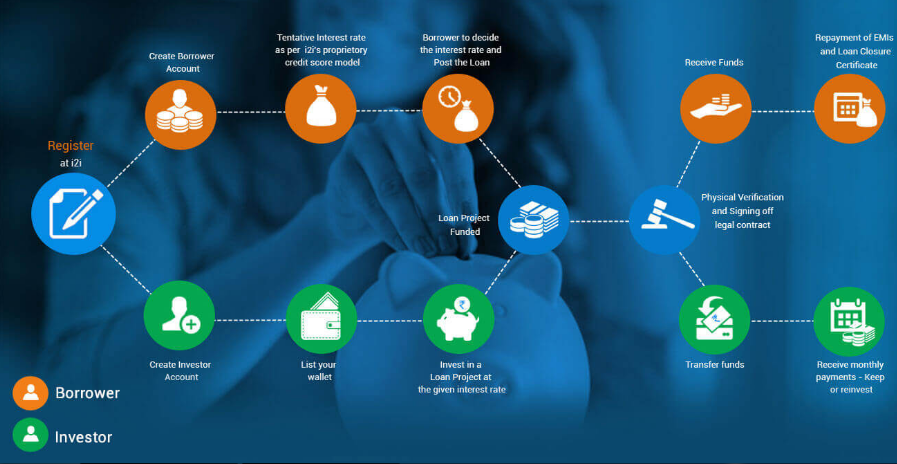

The below snapshots shows how i2iFunding bridges the gap in the best way possible and how it works.

As you see from the above snapshots, a borrower can borrow loans at a minimum rate of 12% p.a. and the lender (investor) can earn returns up to 30% p.a. with principal protection, principal definitely being a deal breaker.

Also, as a wise man once said “don’t invest all your eggs in one basket” at i2i a lender can only fund maximum up to 20% of loan requested by a borrower. Thus, it gives the opportunity to the lender to lend funds to different borrowers at the same time.

The platform is very user friendly and follows the above procedure for smooth processing of P2P funding thus ensuring that the process is as simple as possible, yet authentic.

What sets apart i2iFunding is their role of having their own credit score model wherein they source information ranging from personal to financial and physical verification for borrowers which helps them in verifying the authenticity, thus in turn safeguarding both the lenders’ and borrowers’ interest.

Based on the detailed analysis, a risk category (i2i Risk Category) is assigned and an i2i Recommended Interest Rate is suggested along with i2i Report for each of the loans. Thus, this acts as a benchmark for both the borrowers and the investors to not only set the final interest rate but also to understand the risks associated with each loan.

Contracts and agreements are also drafted with utmost care to combat various legal and litigation scenarios with suitable recourse so that incase of any issues the same is legally enforceable in the court of law.

Loans are monitored w.r.t repayment and collection so that timely payments are made and immediate actions are taken for any default or delay. Suggestion for corrective action plans and assistance in loan recovery and collection is also given.

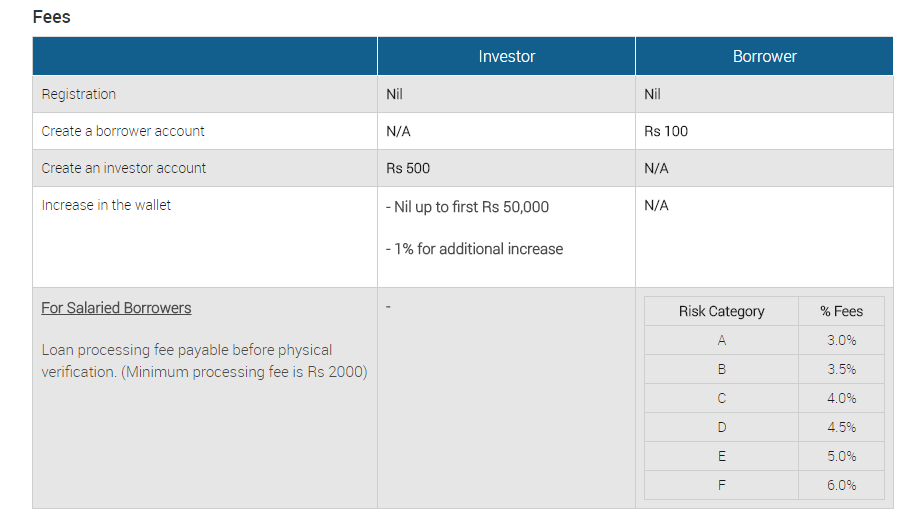

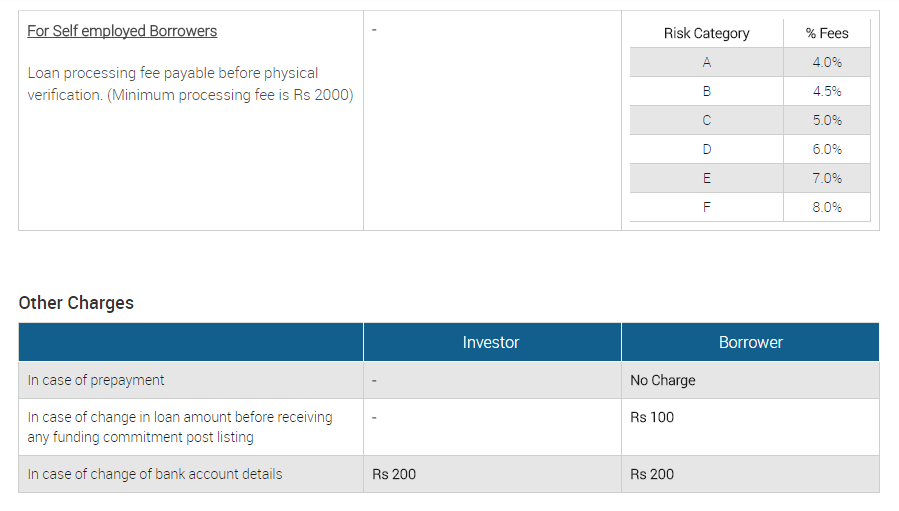

Their charges are as follows :-

There are no charges on prepayment which is a great facility to help borrowers get rid of their loans as early as possible to be loan free.

Looking at the above streamlined and hassle free way of lending and borrowing i2iFunding.com is a great alternative for not only borrowers but investors too to switch over from the traditional banking model.

Disclaimer- Financial instrument recommended for review, however my opinions and thoughts are true and honest.

There are 2 comments

Thanks for sharing this great post.

Thanks for sharing this great post